Looking For Plagiarism Free Answers For Your UAE College/ University Assignments.

BUY NOWMicroeconomics Assignment Questions 2026 | UAE Assignment Help

| University | Ajman University ( AU) |

|---|---|

| Subject | Microeconomics |

Microeconomics Assignment

A few notes:

- Please, answer the questions concisely.

- Please, highlight your answer in blue in order to ease the grading process.

- Do not copy paste answers from Google or Chat GPT as this can be easily verified.

QUESTIONS:

1. Why do economists oppose policies that restrict trade among nations?

2. Explain why economists usually oppose raising minimum wages from the point of view of supply, demand and price theory.

3. What is “efficiency” in terms of consumer surplus and producer surplus? Is it the only goal of economic policymakers? If not, what other goals are there?

4. A sales tax is in theory proportional. However, some economists see it as a regressive tax. Why?

5. A price change causes the quantity demanded of a good to decrease by 30 percent, while the total revenue of that good increases by 15 percent. Is the demand curve elastic or inelastic? Explain.

6. The price elasticity of demand for heating oil is 0.2 in the short run and 0.7 in the long run. How would you describe the change in this elasticity? Why might this elasticity depend on the time horizon?

7. The government decides to fight air pollution by reducing the use of gasoline. They impose a $0.50 tax on each liter of gasoline sold.

a. Should they impose this tax on producers or consumers?

b. If the demand for gasoline were more elastic, would this tax be more effective or less effective in reducing the quantity of gasoline consumed? c. Are consumers of gasoline helped or hurt by this tax? Why?

c. Are workers in the oil industry helped or hurt by this tax? Why?

d. What determines who gets affected more?

8. Consider the market for minivans. For each of the events listed here, explain what happens to supply and demand (mention any shifts of curves, or movements along the curves).

a. People decide to have more children.

b. A strike by steelworkers raises steel prices.

c. Engineers develop new automated machinery for the production of minivans.

d. The price of sports utility vehicles rises.

e. A stock market crash lowers people’s wealth.

9. Consider a country that imports a good from abroad. For each of the following statements, state whether it is true or false. Explain your answer.

a. “The greater the elasticity of demand, the greater the gains from trade.”

b. “If demand is perfectly inelastic, there are no gains from trade.”

c. “If demand is perfectly inelastic, consumers do not benefit from trade.”

10. Explain one argument for and one argument against government redistribution of income, using efficiency and equity concepts.

11. College students sometimes work as summer interns for private firms or the government.

Many of these positions pay little or nothing.

a. What is the opportunity cost of taking such a job?

b. Explain why students are willing to take these jobs.

c. If you were to compare the earnings later in life of workers who had worked as interns and those who had taken summer jobs that paid more, what would you expect to find?

12. When recording devices were first invented more than 100 years ago, musicians could suddenly supply their music to large audiences at low cost. How do you suppose this development affected the income of the best musicians? How do you suppose it affected the income of average musicians?

13. If the government places a $500 tax on luxury cars, will the price paid by consumers rise by more than $500, less than $500, or exactly $500? Explain.

14. There are many types of costs: opportunity cost, total cost, fixed cost, variable cost, average total cost, and marginal cost (MC). Fill in the type of cost below:

a. What you give up in taking some action is called the ______.

b. _____ is falling when MC is below it and rising when MC is above it.

c. A cost that does not depend on the quantity produced is a(n) ______.

d. In the ice-cream industry in the short run, ______includes the cost of cream and sugar but not the cost of the factory.

e. Profits equal total revenue minus ______.

f. The cost of producing an extra unit of output is the ______.

15. You are hired as a consultant to a monopolistically competitive firm. The firm reports the following information about its price, marginal cost, and average total cost. Can the firm possibly be maximizing profit? If not, what should it do to increase profit? If the firm is maximizing profit, is the market in a long-run equilibrium? If not, what will happen to restore long-run equilibrium?

a. P < MC, P > ATC

b. P > MC, P < ATC

c. P = MC, P > ATC

d. P > MC, P = ATC

PROBLEMS

16. If the tax code exempts the first $20,000 of income from taxation and then taxes 25% of all income above that level, then a person who earns $50,000 has an average tax rate of _____ percent and a marginal tax rate of _____ percent.

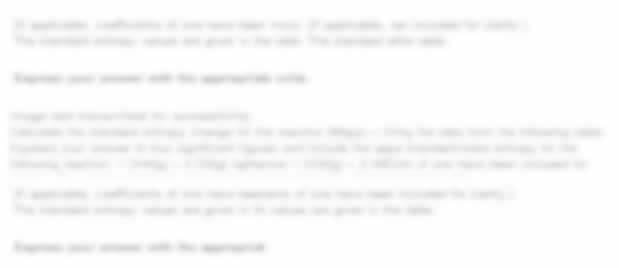

17. Suppose that business travelers and vacationers have the following demand for airline tickets from New York to Boston:

a. As the price of tickets rises from $200 to $250, what is the price elasticity of demand for (i) business travelers and (ii) vacationers? (Use the midpoint method in your calculations.)

b. Why might vacationers have a different elasticity from business travelers?

18. A friend of yours is considering two cell phone service providers. Provider A charges $120 per month for the service regardless of the number of phone calls made. Provider B does not have a fixed service fee but instead charges $1 per minute for calls. Your friend’s monthly demand for minutes of calling is given by the equation “150-50P”, where P is the price of a minute.

a. With each provider, what is the cost to your friend of an extra minute on the phone?

b. Which provider would you recommend that your friend choose? Why?

19. Hotel rooms in Smalltown go for $100, and 1,000 rooms are rented on a typical day. To raise revenue, the mayor decides to charge hotels a tax of $10 per rented room. After the tax is imposed, the going rate for hotel rooms rises to $108, and the number of rooms rented falls to 900. Calculate the amount of revenue this tax raises for Smalltown and the deadweight loss of the tax.

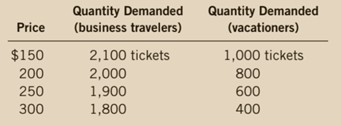

20. There are three industrial firms in Happy Valley as follows:

The government wants to reduce pollution to 60 units, so it gives each firm 20 tradable pollution permits.

a. Who sells permits and how many do they sell? Who buys permits and how many do they buy? Briefly explain why the sellers and buyers are each willing to do so. What is the total cost of pollution reduction in this situation?

b. How much higher would the costs of pollution reduction be if the permits could not be traded?

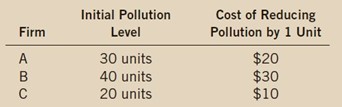

21. Four roommates are planning to spend the weekend in their dorm room watching movies, and they are debating how many to watch. Here is their willingness to pay for each film:

a. Within the dorm room, is the showing of a movie a public good? Why or why not?

b. If it costs $8 to rent a movie, how many movies should the roommates rent to maximize total surplus?

c. If they choose the optimal number from part (b) and then split the cost of renting the movies equally, how much surplus does each person obtain from watching the movies?

d. Is there any way to split the cost to ensure that everyone benefits? What practical problems does this solution raise?

e. Suppose they agree in advance to choose the efficient number and to split the cost of the movies equally. When Steven is asked his willingness to pay, will he have an incentive to tell the truth? If so, why? If not, what will he be tempted to say?

22. A profit-maximizing firm in a competitive market is currently producing 100 units of output. It has average revenue of $10, average total cost of $8, and fixed cost of $200. a. What is its profit?

a. What is its marginal cost?

b. What is its average variable cost?

c. Is the efficient scale of the firm more than, less than, or exactly 100 units?

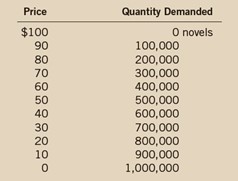

23. A publisher faces the following demand schedule for the next novel from one of its popular authors:

The author is paid $2 million to write the book, and the marginal cost of publishing the book is a constant $10 per book.

a. What quantity would a profit-maximizing publisher choose? What price would it charge?

b. At what quantity do the marginal- revenue and marginal-cost curves cross? What does this signify? How large is the deadweight loss (if measured as number of novels)?

c. If the author were paid $3 million instead of $2 million to write the book, how would this affect the publisher’s decision regarding what price to charge?

d. Suppose the publisher was not profit-maximizing but was concerned with maximizing economic efficiency. What price would it charge for the book? How much profit would it make at this price?

24. In the country of Narnia, there are only two airlines. Suppose that each company can charge either a high price for tickets or a low price. If one company charges $300, it earns low profit if the other company also charges $300 and high profit if the other company charges $600. On the other hand, if the company charges $600, it earns very low profit if the other company charges $300 and medium profit if the other company also charges $600.

a. Draw the decision box for this game.

b. What is each airline’s dominant strategy and why? What is the resulting equilibrium called?

c. Is there an outcome that would be better for both airlines? How could it be achieved? Who would lose if it were achieved?

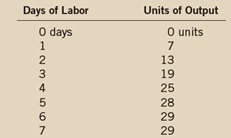

25. Suppose that labor (=workers) is the only input used by a perfectly competitive firm. The firm’s production function is as follows (*In the graph below, “days of labor” should be changed to “number of workers”!):

a. Each unit of output sells for $10. Calculate the value of the marginal product of each worker.

b. Compute the demand schedule showing the number of workers hired for all wages from zero to $100 a day. (In your answer, use categories, e.g. “from $20 to $30 -> 10 workers), “from $30 to $40 -> 9 workers”, etc.)

c. What happens to this demand curve if the price of output rises from $10 to $12 per unit?

END

Get help by expert

Many students struggle with the Microeconomics Assignment because concepts like elasticity, taxes, surplus, market efficiency, and firm behaviour require clear economic reasoning. Often, students understand the theory but find it difficult to apply it concisely in exam-style answers or face time constraints. There’s no need to worry—UAE Assignment Help provides expert Microeconomics Assignment Help written strictly according to academic requirements. For trust and confidence, you can also review assignment solutions prepared by our economics experts. Order today with Ajman Assignment Helper and receive a fully customised, plagiarism-free, human-written solution prepared only for you.

Recent solved questions

- Microeconomics Assignment Questions 2026 | UAE Assignment Help

- Ethics, Corporate Social Responsibility (CSR), and Corporate Governance Assignment | UAEU

- CIPD Level 5 5OS02 Advances in digital learning and development Learner Assessment Brief

- CIPD Level 5 5OS05 Equality, diversity and inclusion Learner Assessment Brief

- Principles of Microeconomics Assignment | UAE University

- CIPD 5HR02 Talent Management and Workforce Planning Group Assignment Written Brief

- CIPD 5HR01 Employment Relationship Management Group Assessment September 2024

- CIPD 3CO04 Essentials of People Practice Learner Assessment Brief Case Study June 2025

- CIPD 5CO03 Professional Behaviours and Valuing People Learner Assessment Brief June 2025

- CIPD 5CO02 Evidence Based Practice Level 5 Associate Diploma Learner Assessment Brief June 2025